Capitol Correspondence - 04.26.21

Jobs and Infrastructure Package in Flux as Health Components at Risk, ANCOR Advocates for Health Provisions

Share this page

Stay Informed on the Latest Research & Analysis from ANCOR

More News

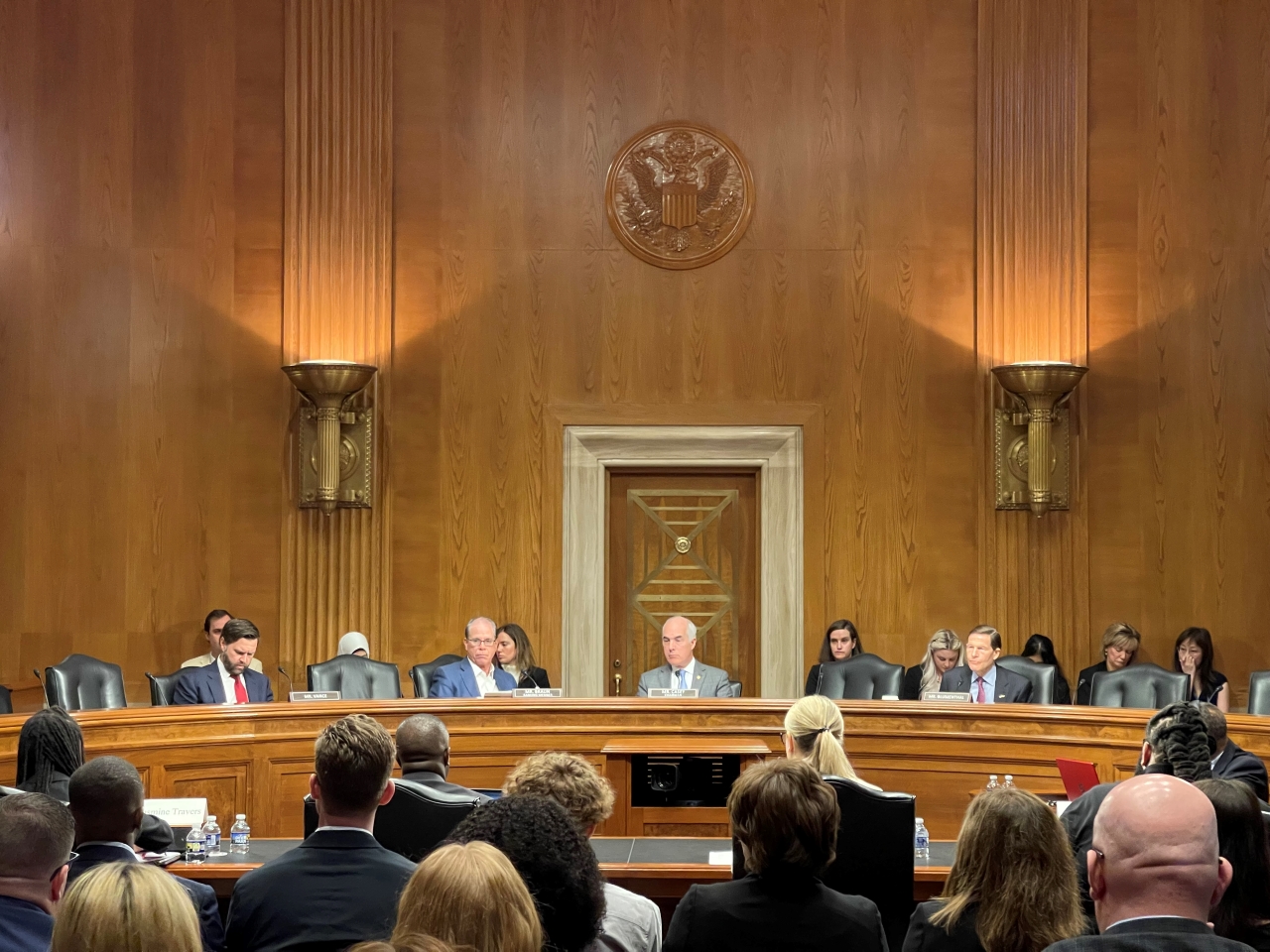

Capitol Correspondence - 04.23.24

Senate Aging Committee Explores Long-Term Care Workforce Challenges

Capitol Correspondence - 04.23.24

White House Marks Anniversary of Executive Order on Care with Focus on Workforce Support

Capitol Correspondence - 04.23.24