Connections - 02.28.24

Retirement Plans for Long-Term Part-Time Workers

Share this page

Stay Informed on the Latest Research & Analysis from ANCOR

More News

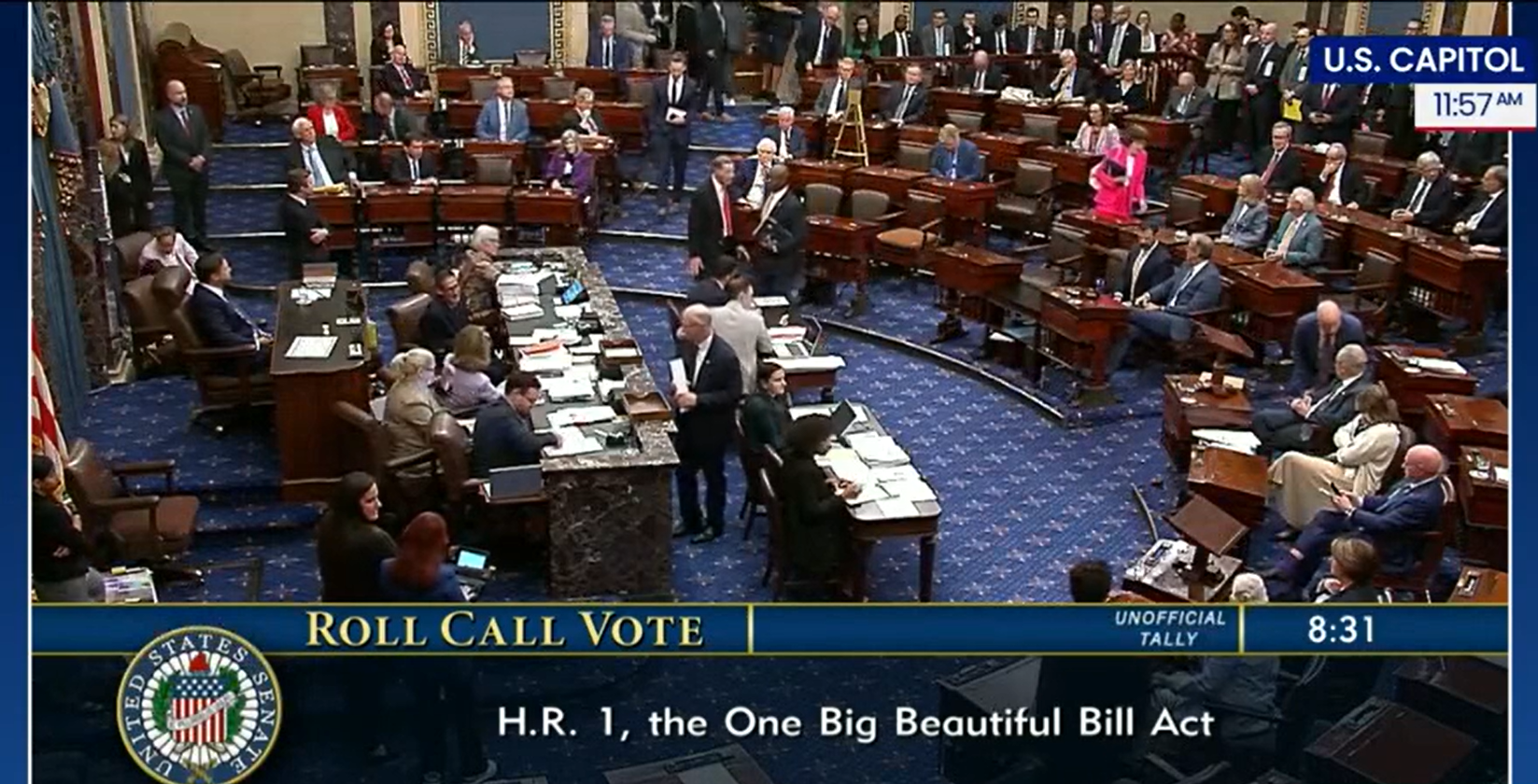

Capitol Correspondence - 06.24.25

New Resource Highlights the Impact of Medicaid Work Requirements on the Direct Care Workforce

Stateside Report - 06.02.25

Stateside Report: June 02, 2025